2025 Tax Brackets: Married Jointly Married - Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, For tax year 2025, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%. To figure out your tax bracket, first look at the rates for the filing status you plan to use: 2025 Tax Brackets Married Filing Separately Married Gerta Juliana, If filing jointly as a. Based on your annual taxable income and filing status, your tax bracket determines your.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, For tax year 2025, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%. To figure out your tax bracket, first look at the rates for the filing status you plan to use:

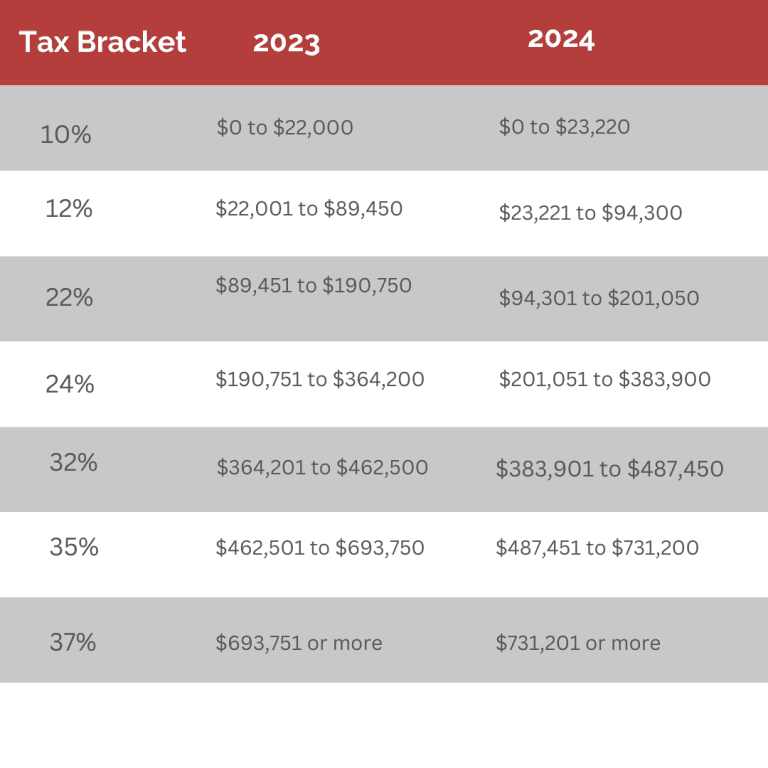

In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any.

2025 Tax Brackets Married Filing Jointly Irs Alysa Bertina, The federal income tax has seven tax rates in 2025: The calculator below can help estimate the financial impact of filing a joint tax return as a married couple (as opposed to filing separately as singles) based on 2025 federal.

As the new tax year approaches, it’s essential for married couples to be aware of the latest tax brackets for married filing jointly in 2025 and 2025.

For tax year 2025, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%. If filing jointly as a.

Tax Bracket Changes 2025 For Single, Household, Married Filling, The standard deduction rate for 2025 for a single filer is $14,600. 10% for single filers with incomes of $11,600 or less and for married couples filing a joint tax return with incomes of $23,200 or less.

2025 Tax Rates And Brackets Married Filing Jointly Standard Deduction, Get updated on property taxes, income taxes, gas taxes, and more! There are seven federal tax brackets for tax year 2025.

In 2025, a single taxpayer can. As the new tax year approaches, it’s essential for married couples to be aware of the latest tax brackets for married filing jointly in 2025 and 2025.

2025 Tax Brackets Announced What’s Different?, For example, for a married couple filing jointly with $95,000 in taxable income, their marginal tax rate for 2025 would be 22% even though they are only paying. The federal income tax has seven tax rates in 2025:

Irs 2025 Tax Tables Married Jointly Irina Leonora, In 2025, a single taxpayer can. See current federal tax brackets and rates based on your income and filing status.

Tax Brackets 2025 Married Jointly Karry Marylee, Get updated on property taxes, income taxes, gas taxes, and more! In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700).

2025 Tax Brackets Married Filing Jointly Irs Shani Melessa, For example, for a married couple filing jointly with $95,000 in taxable income, their marginal tax rate for 2025 would be 22% even though they are only paying. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

2025 Tax Brackets Calculator Married Jointly Ira Heloise, 10% for single filers with incomes of $11,600 or less and for married couples filing a joint tax return with incomes of $23,200 or less. Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married.

To figure out your tax bracket, first look at the rates for the filing status you plan to use:

Individual income tax rate brackets married filing jointly and surviving spouses projected 2025 tax rate bracket income ranges.